You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

SYLLABUS

GS-3: Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment.

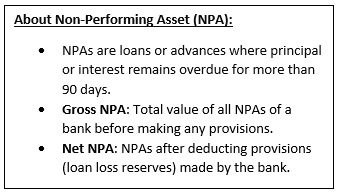

Context: India’s banking sector recorded a sharp improvement in asset quality as gross non-performing assets declined to a multi-decade low by September 2025.

More on the News

• The Reserve Bank of India released a Report on Trend and Progress of Banking in India 2024-25, highlighting sustained improvement in the asset quality of scheduled commercial banks.

• The report assessed trends in gross and net NPAs recovery performance, slippages and restructuring during 2024–25.

• It showed that better recoveries and account upgrades played a major role in reducing stressed assets.

Key Findings on Asset Quality

• Gross NPA ratio: Declined to 2.1 per cent at the end of September 2025 from 2.2 per cent in March 2025.

• Net NPA ratio: remained stable at 0.5 per cent during the same period.

• The improvement in asset quality has continued consistently since 2018–19.

Bank-wise Trends

• Public sector banks reduced their GNPA ratio to 2.6 per cent from 3.5 per cent.

• Private sector banks recorded a marginal improvement with GNPA falling to 1.8 per cent.

• Foreign banks improved their asset quality with GNPA declining to 0.9 per cent.

• Small finance banks witnessed deterioration in asset quality with GNPA rising to 3.6 per cent.

Role of Recoveries and Upgrades

• Nearly 42.8 per cent of the reduction in GNPAs during 2024–25 was due to recoveries and upgrades.

• Banks recovered bad loans worth ₹67,693 crore.

• Stressed accounts worth ₹50,087 crore were upgraded to standard assets.

Slippages and Standard Assets

• The slippage ratio declined for the fifth consecutive year to 1.4 per cent at the end of March 2025.The slippage ratio in banking is a key metric that measures the rate at which a bank's good (standard) loans are turning into non-performing assets (NPAs) within a specific period.

• By September 2025, the slippage ratio further improved to 1.3 per cent.

• The share of standard assets in total advances rose to 97.7 per cent for scheduled commercial banks.

Restructured Advances

• The ratio of restructured standard advances declined for both overall and large borrowal accounts.

• Public sector banks led the reduction in restructured advances.

• Private sector banks continued to have a lower share of restructured standard advances than public sector banks.

Significance of the Report

• Reinforces Confidence in Financial Stability: The sustained decline in bad loans demonstrates that India’s banking system is structurally stronger, enhancing confidence among investors, depositors and global rating agencies.

• Creates Headroom for Sustainable Credit Expansion: Improved asset quality and strong capital buffers enable banks to expand lending without compromising prudential norms, supporting long-term economic growth.

• Validates Effectiveness of Regulatory Interventions: The report reflects the success of RBI’s past supervisory actions on stressed assets and retail credit, indicating improved risk management across banks.

• Signals Institutional Readiness for Emerging Risks: By integrating climate risk assessment into financial oversight, the report shows that India’s banking regulator is preparing the system for future systemic and transition risks.

NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details