You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

SYLLABUS

GS-2: Government Policies and Interventions for Development in various sectors and Issues arising out of their Design and Implementation.

GS-3: Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

Context: The recent World Bank’s State and Trends of Carbon Pricing 2025 report highlights that carbon markets across the world are expanding at an unprecedented scale.

Key findings of the Report

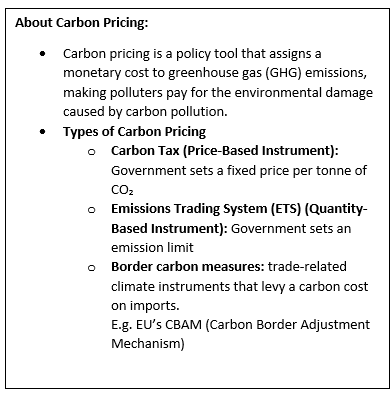

• Booming of Carbon Market: Global revenues from carbon taxes and emissions trading systems crossed $100 billion for the second consecutive year.A carbon market is a market-based mechanism that puts a price on carbon emissions, allowing entities to buy and sell emission permits or carbon credits to reduce greenhouse gas (GHG) emissions cost-effectively.

• Growing acceptance of carbon pricing: Nearly 28 per cent of global greenhouse gas (GHG) emissions are now covered by a direct carbon price, compared to just 5 per cent in 2005.

• Carbon pricing being used as a fiscal instrument: In 2024, 56% of global carbon pricing revenues were directed towards environmental programmes, infrastructure and development spending.

• Supply Outstrips Demand: The supply of carbon credits continued to outpace demand, leaving nearly 1 billion tonnes of unretired credits in global markets.

• Key Challenges:

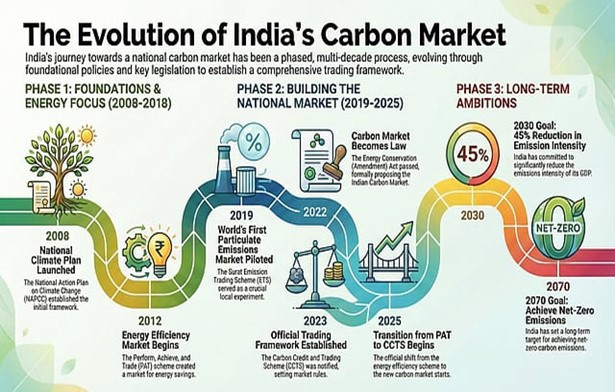

• India-specific findings:

NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details